Okay, so I’m trying to start investing while sitting in my tiny-ass Boston apartment, where the radiator’s clanking like it’s possessed and my coffee mug’s leaking on my desk. I’m just a guy who’s tired of checking my bank account and praying there’s enough for takeout.

Picture me last summer, at a Dunkin’ in Somerville, realizing my card got declined for a $4 iced coffee. It’s for regular people like me, with coffee stains on their shirts.

But, man, I was scared. Like, what if I lost everything? My brain was yelling, “You’re gonna blow it!” while I scrolled X for tips at 1 a.m. Still, I was done being broke, so I jumped in, heart pounding like I was asking someone out.

Step 1: What Even Is Start Investing?

I thought investing for beginners meant buying stocks and yelling “Buy low, sell high!” like in movies. Wrong. It’s about putting money into stuff—stocks, bonds, ETFs—that might grow over time. I found this NerdWallet guide that explained it without making me feel like a total dummy.

Here’s the basics I figured out:

Robo-advisors: Apps that invest for you. I went with one because, yeah, I didn’t trust myself.terest.

Stocks: You own a tiny piece of a company. Risky, but could pay off big.

Bonds: Like lending money to someone who pays you back with interest. Boring but safe.

ETFs: A mix of stocks or bonds. Less stressful for newbies like me.

My First Investment: A Hot Mess

So, I downloaded a robo-advisor app, threw in $150 (all I could afford after rent and that dumb Dunkin’ incident), and felt like a genius. Then I checked the app, like, every 20 minutes. Big oof. The market dipped, and I was convinced I’d lost it all. I was stress-eating pretzels on my couch, crumbs everywhere, refreshing the app like a maniac. Turns out, it was just a normal dip, but I was a wreck. Lesson one: beginner investing means calming the hell down and thinking long-term.

Then I got cocky and tried to “time the market.” Saw some dude on X hyping a biotech stock, so I dumped $40 into it. It crashed. I was at a bar, checking my phone, muttering, “Why did I do this?” while my friends laughed. Lesson two: don’t follow random tips without research.

How to Start Investing Without Totally Losing It

Alright, here’s my start investing advice, straight from my caffeine-fueled disasters:

Get Your Money in Order First

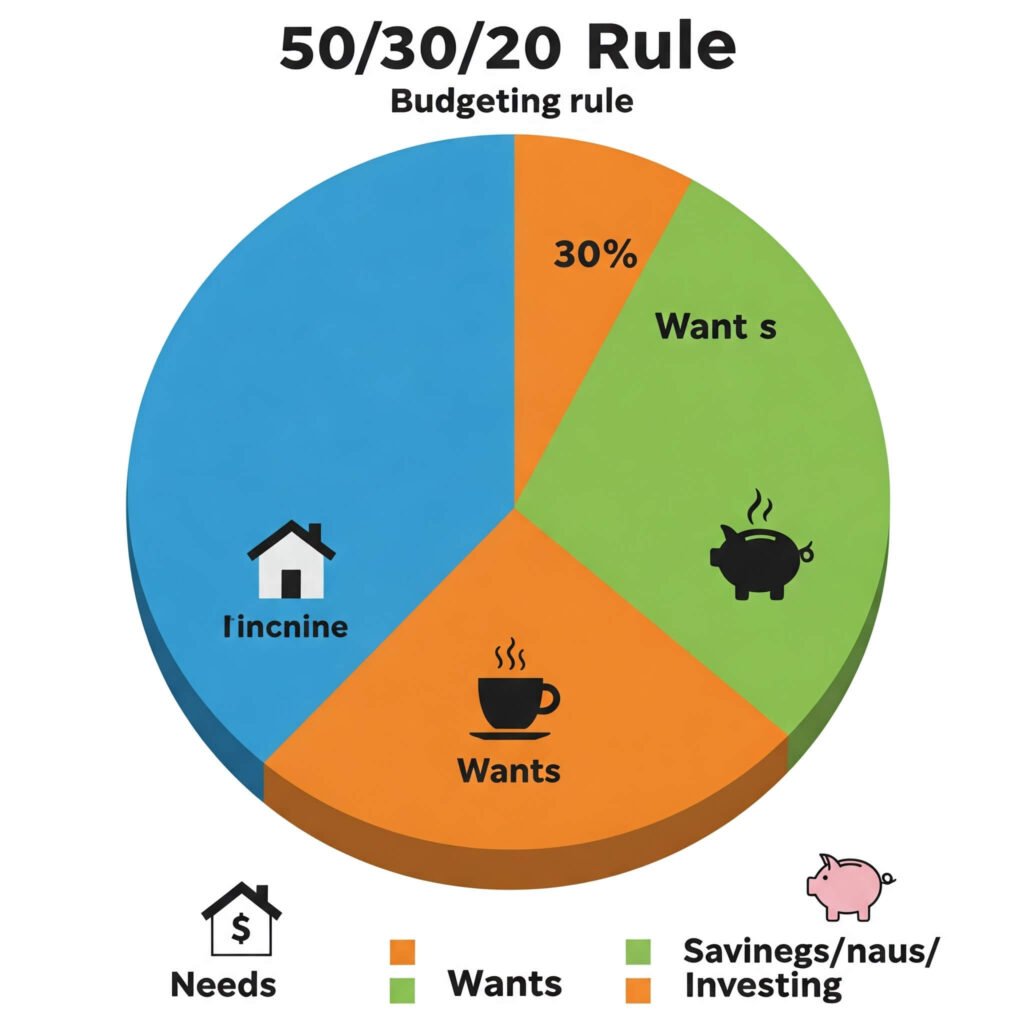

You can’t invest money if you’re broke like I was. I learned this the hard way. Here’s what you need:

- Emergency fund: Save 3-6 months of expenses. I started with $10 a week in a savings account.

- Pay off bad debt: My credit card had 22% interest. Ouch. Paid that down first.

- Budget: I use YNAB, and it’s honestly saved my butt.

Pick an Easy Platform

There’s a ton of apps, and I tried too many. My go-tos:

- Betterment: Idiot-proof, does the hard stuff for you. Perfect for beginner investing.

- Fidelity: More control, and their support doesn’t treat you like a moron.

- Robinhood: Kinda fun, but it’s too easy to treat it like a game, which I did, and it wasn’t great.

I stuck with Betterment, setting up $40 a month to auto-invest. Set it, forget it, don’t stress it.

Start Tiny, Don’t Be Dumb

You don’t need a fortune to start investing. I began with $150, and it was fine. Think of your money as little plants you’re growing to grow wealth. Some flop, some bloom, but you gotta plant them.

Learn, But Don’t Overdo It

I read The Intelligent Investor (so dense, ugh) and scrolled X way too much. But overthinking made me freeze. You don’t need to be a finance nerd to invest money. Check out The Motley Fool for beginner-friendly stuff that doesn’t suck.

Actionable Takeaway: Read one beginner-friendly investing book, like The Simple Path to Wealth by JL Collins, to deepen your understanding.

Actionable Takeaway: Open a Roth IRA or taxable brokerage account this month. Start with as little as $100.

The Emotional Chaos of Investing

Nobody tells you investing for beginners is like riding a rollercoaster blindfolded. One day, your ETF’s up 4%, and you’re like, “I’m a genius!” Next day, it’s down 3%, and you’re googling “how to sell everything.” I had a full-on panic attack when my first stock dropped $25. My cat was staring at me like, “Dude, chill.” My roommate just handed me a seltzer and said, “You’ll live.”

What helped? Focusing on the big picture. I want to retire someday, maybe see Japan without selling my kidney. Also, chatting with other newbies on X made me feel less like a failure.

Dumb Mistakes I Made (Learn From Me)

I messed up a lot, so here’s what not to do:

- Obsessing over your portfolio: Checking it daily is a trap. Monthly’s fine.

- Using money you need: I almost invested my grocery cash. Don’t.

- Chasing hot tips: X is cool, but cross-check with CNBC Finance.

- Not spreading it out: Don’t dump all your cash in one stock. I did. It hurt.

Actionable Takeaway: Invest in a low-cost S&P 500 index fund to start. Example: VOO (Vanguard S&P 500 ETF).

Wrapping Up: Just Freaking Start

I’m no expert, just a dude with a sticky keyboard and a dream to grow wealth. My apartment smells like burnt coffee, and I still get jumpy checking my investments. But I’m learning, and my money’s growing—slowly, messily, but it’s happening. If I can start investing, you can too. Don’t let the fear win.

Outbound Link: NerdWallet – How to Start Investing in Any Market: A Beginner’s Guide: