Introduction: Why Choose the Best High-Yield Savings Accounts in 2025?

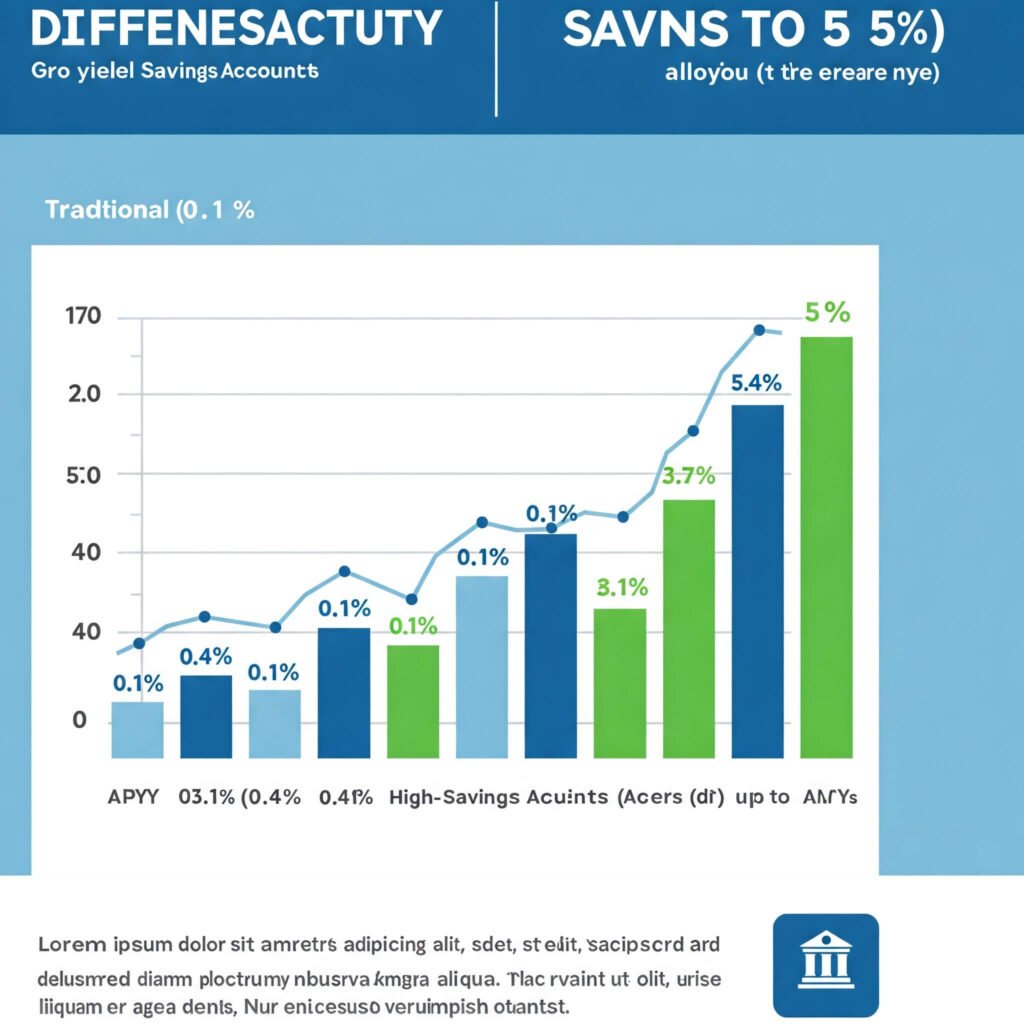

In 2025, the best high-yield savings accounts are a game-changer for anyone looking to grow their money faster without taking risks. Unlike traditional savings accounts offering a measly 0.41% APY (according to FDIC data), high-yield savings accounts (HYSAs) can deliver rates as high as 5% or more, helping you maximize your savings effortlessly. Whether you’re building an emergency fund or saving for a dream vacation, choosing the right HYSA is crucial. This guide explores the top high-yield savings accounts for 2025, packed with actionable insights to help you make informed decisions.

What Are High-Yield Savings Accounts?

High-yield savings accounts are specialized savings accounts offered primarily by online banks, providing significantly higher annual percentage yields (APYs) than traditional accounts. These accounts are ideal for short-term savings goals, offering flexibility, safety, and impressive returns.

Key Benefits of High-Yield Savings Accounts

- Higher APYs: Earn up to 5% or more, compared to the national average of 0.41%.

- FDIC Insurance: Your money is safe up to $250,000 per depositor.

- No or Low Fees: Most HYSAs have no monthly maintenance fees.

- Easy Access: Withdraw funds when needed, though some accounts may limit transactions.

For example, if you deposit $10,000 in an HYSA with a 4.5% APY, you could earn around $450 in interest annually, compared to just $41 in a traditional account.

Top 5 Best High-Yield Savings Accounts for 2025

Here’s our curated list of the best high-yield savings accounts for 2025, based on APYs, fees, and features. Always verify current rates before opening an account, as they can fluctuate.

1. Varo Bank: 5.00% APY

- Why It Stands Out: Varo offers one of the highest APYs at 5.00% for balances up to $5,000, with no minimum deposit.

- Features: No monthly fees, FDIC-insured, and requires an accompanying Varo Bank Account.

- Best For: Savers looking for top-tier rates with low balances.

- Source: Investopedia

2. Ally Bank: 4.00% APY

- Why It Stands Out: Ally combines a competitive 4.00% APY with user-friendly tools like savings buckets to organize goals.

- Features: No fees, no minimum deposit, FDIC-insured, and a top-rated mobile app.

- Best For: Tech-savvy savers who want robust digital tools.

- Source: Plently

3. Marcus by Goldman Sachs: 4.10% APY

- Why It Stands Out: Marcus offers a strong 4.10% APY with no minimum deposit or fees.

- Features: Excellent customer service, FDIC-insured, and a simple online platform.

- Best For: Those prioritizing ease of use and reliability.

- Source: Plently

4. Capital One 360 Performance Savings: 3.60% APY

- Why It Stands Out: Capital One blends online convenience with physical branches, offering a 3.60% APY.

- Features: No fees, no minimum deposit, FDIC-insured, and great customer service.

- Best For: Savers who value in-person banking options.

- Source: Forbes

5. Discover Online Savings: 4.10% APY

- Why It Stands Out: Discover offers a 4.10% APY for balances under $250,000, plus a $150-$200 sign-up bonus (offer expires 09/11/2025).

- Features: No fees, no minimum deposit, FDIC-insured, and savings goal tools.

- Best For: New savers seeking bonuses and competitive rates.

- Source: NerdWallet

How to Choose the Best High-Yield Savings Account for You

Selecting the best high-yield savings account depends on your financial goals and preferences. Here are key factors to consider:

1. Compare APYs

Higher APYs mean faster growth. Check for tiered APYs, as some accounts (e.g., CIT Bank) offer better rates for larger balances.

2. Check Fees and Minimums

Look for no-fee accounts with low or no minimum deposits, like Ally or Marcus, to maximize your returns.

3. Evaluate Accessibility

Ensure the bank’s app or website is user-friendly. For example, Ally’s mobile app is highly rated for managing savings on the go.

4. Confirm FDIC Insurance

All accounts listed here are FDIC-insured up to $250,000, ensuring your money’s safety.

5. Look for Bonuses

Some banks, like Discover, offer sign-up bonuses, adding extra value to your account.

Pro Tip: Use a savings calculator, like the one offered by EverBank, to estimate your earnings over time.

Why 2025 Is the Year to Open a High-Yield Savings Account

The Federal Reserve’s actions in 2024, including three rate cuts, have slightly lowered HYSA rates from their 5%+ peaks. However, with the federal funds rate steady at 4.25%-4.50% as of May 2025, competitive APYs remain available. Experts predict rates may decline further, so locking in a high rate now could be a smart move.

For instance, Jane, a 30-year-old teacher, switched from a traditional savings account to an Ally HYSA in 2024. With a 4.00% APY, her $5,000 emergency fund grew by $200 in a year—20 times more than her old bank’s 0.20% rate.

Actionable Tips to Maximize Your High-Yield Savings Account

To get the most out of the best high-yield savings accounts in 2025, follow these tips:

- Automate Deposits: Set up recurring transfers to consistently grow your savings.

- Monitor Rates: APYs can change, so check periodically to ensure you’re getting the best deal.

- Diversify Goals: Use tools like Ally’s savings buckets to allocate funds for different purposes (e.g., travel, emergencies).

- Avoid Withdrawals: Minimize transactions to maintain your balance and earn the full APY.

Conclusion: Start Growing Your Money with the Best High-Yield Savings Accounts

The best high-yield savings accounts for 2025 offer a safe, low-effort way to grow your money faster. With APYs up to 5%, no-fee structures, and FDIC insurance, accounts like Varo, Ally, and Marcus make saving smarter and more rewarding. Take action today—compare rates, open an account, and watch your savings soar.

Which high-yield savings account will you choose in 2025? Share your thoughts in the comments below!

Outbound Link: Best High-Yield Savings Accounts of May 2025: