Anyway, these budgeting strategies for beginners? They’re the hacks that got me to stash $500, even if I still check my balance like it’s a reality TV cliffhanger. Raw confession: I’m just a peach-loving Atlantan fumbling finances, hyped for savings but paranoid about splurges—contradiction city, ‘cause I’m stoked for progress but dreading the next bill.

My Messy Budgeting Strategies for Beginners to Start Saving

Ugh, let’s rewind to July ‘25—I’m sprawled on my couch, the sticky Atlanta air smelling like sweet tea and regret, panicking ‘cause my savings account’s at $12 and average Americans save 8.5% of income yearly. Budgeting strategies for beginners are about tracking spending, cutting fluff, and building habits—spoiler: I learned this after overspending on food trucks and facing a $50 overdraft fee. These tips? Born from my sweaty scrolls, late-night app checks, and one mortifying bank call where I misread my balance. Tip from my flops: start small; I tried saving half my paycheck and crashed. Contradiction: I preach control, yet I impulse-bought sneakers during a rainstorm—chaos vibes.

Tip 1: Track Every Penny with Budgeting Strategies for Beginners

Start budgeting strategies for beginners by tracking every cent—apps like Mint help. I tried pen-and-paper in a humid haze, spilled tea on my ledger, lost a week’s data—cringe. Mint showed I spent $200 on coffee; cut it to $50, saved $150. Pro: reveals spending leaks. Con: tedious at first; I slacked off once. Check Mint—don’t skip like I did, distracted by a food truck fest.

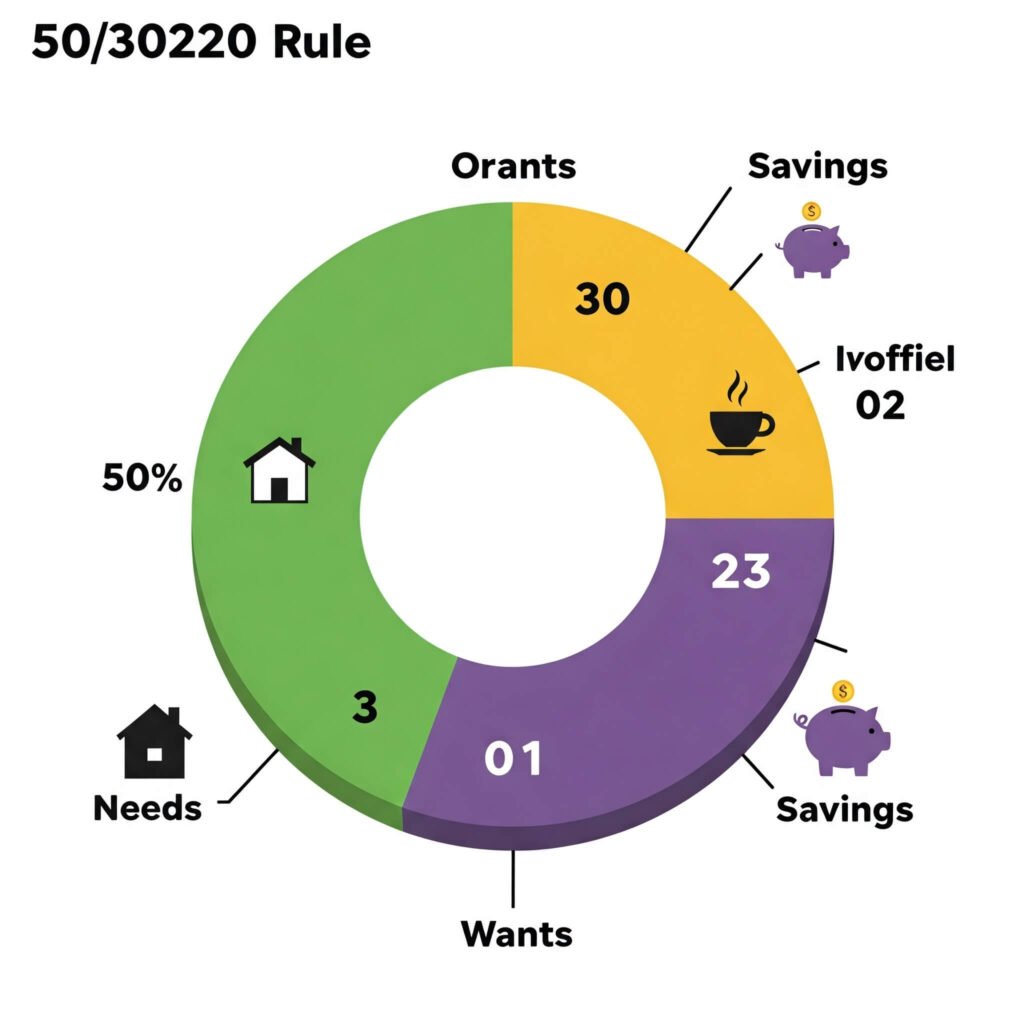

Tip 2: Try the 50/30/20 Rule

The 50/30/20 rule—50% needs, 30% wants, 20% savings—is a solid budgeting strategy for beginners. I ignored it, spent 70% on wants, saved zilch—score one for dumb. Adjusted to 50/30/20, stashed $100 monthly. Pro: simple structure. Con: needs discipline; I overspent on tacos once. Use YNAB to enforce it—saved my scatterbrain.

- My Rookie Tip: Start with 60/30/10 if 20% savings feels wild; eased me in.

- Why It Fit My Mess: Gave my chaotic spending a leash.

Tip 3: Cut Subscription Creep for Budgeting Strategies for Beginners

Subscriptions kill budgets, so audit them for budgeting strategies for beginners. I had $80 in unused apps—Spotify, Netflix, random yoga—canceled half, saved $40 monthly. Pro: quick savings. Con: FOMO hits; I missed one show, sulked. Surprising: free trials sneak up. Check Rocket Money—caught my sneaky subs.

Tip 4: Build an Emergency Fund for Budgeting Strategies for Beginners

An emergency fund is clutch—aim for $500-$1,000. I had $0, then a car repair hit $300, overdrafted—ouch. Saved $50 monthly, hit $600 in a year. Pro: stress buffer. Con: slow build; I skipped coffee runs to fund it. Scope NerdWallet for tips—kept me focused despite festival temptations.

Tip 5: Automate Savings

Automate transfers to savings for budgeting strategies for beginners—set and forget. I forgot to save, spent $200 on a bar tab, regretted it. Set up $25 auto-transfers via Ally Bank, hit $300 in months. Pro: builds savings quietly. Con: needs a funded account; I flubbed once, overdrafted. Surprising: small transfers add up. Don’t skip like I did, distracted by a rainy Uber ride.

Wrapping My Rant

Whew, spilling this while Atlanta’s humidity clings like regret—feels like unloading a backpack of stress. These didn’t erase my flops (that festival splurge? Still stings), but they helped me save $500, dodge overdrafts, and hey, I’m not broke yet. Contradiction: I curse budget apps, yet I’m hyped for my savings—peak Atlanta hustle, right? If you’re in the US grind—bills piling, savings calling—hit these hacks, track spending like I forgot to, and dodge my dumb splurges. Got a budget horror? Spill below, let’s vent over virtual peach cobbler.

Outbound Link: 11 financial resolutions for 2025