Consequently, these checking account tips? They’re the grimy hacks that pulled me outta fee hell, even if I still sneak a $4 latte when I’m “vibing.” To be honest, I’m just a PNW mess fumbling adulting, loving the idea of a flush checking account but hating the fine print—contradiction central, ‘cause I’m hyped for banking but paranoid about fees. Prolly flubbed a fee number somewhere, my bad.

My Messy Guide to Picking a Checking Account in 2025

Flashback to April ‘25—I’m sprawled on my soggy rug, the musty smell of Portland rain creeping through my window, freaking out ‘cause my checking account’s at $15 after a “cheap” music fest ticket turned into a $120 overdraft disaster. For starters, choosing a checking account ain’t just about swiping a debit card; it’s dodging fees when 60% of Americans get hit with overdraft charges yearly. Therefore, these tips? They’re born from my rainy app scrolls, late-night fee rants, and one cringey moment when my card got declined for a $2 coffee—in front of a hipster line, ugh. In fact, my big takeaway from my flops: read the fee schedule; I skipped it and ate a $30 hit. On the other hand, I curse bank fees, yet I’m hooked on a clean checking account—chaos vibes, yo. Might’ve typo’d a balance in my notes, oops.

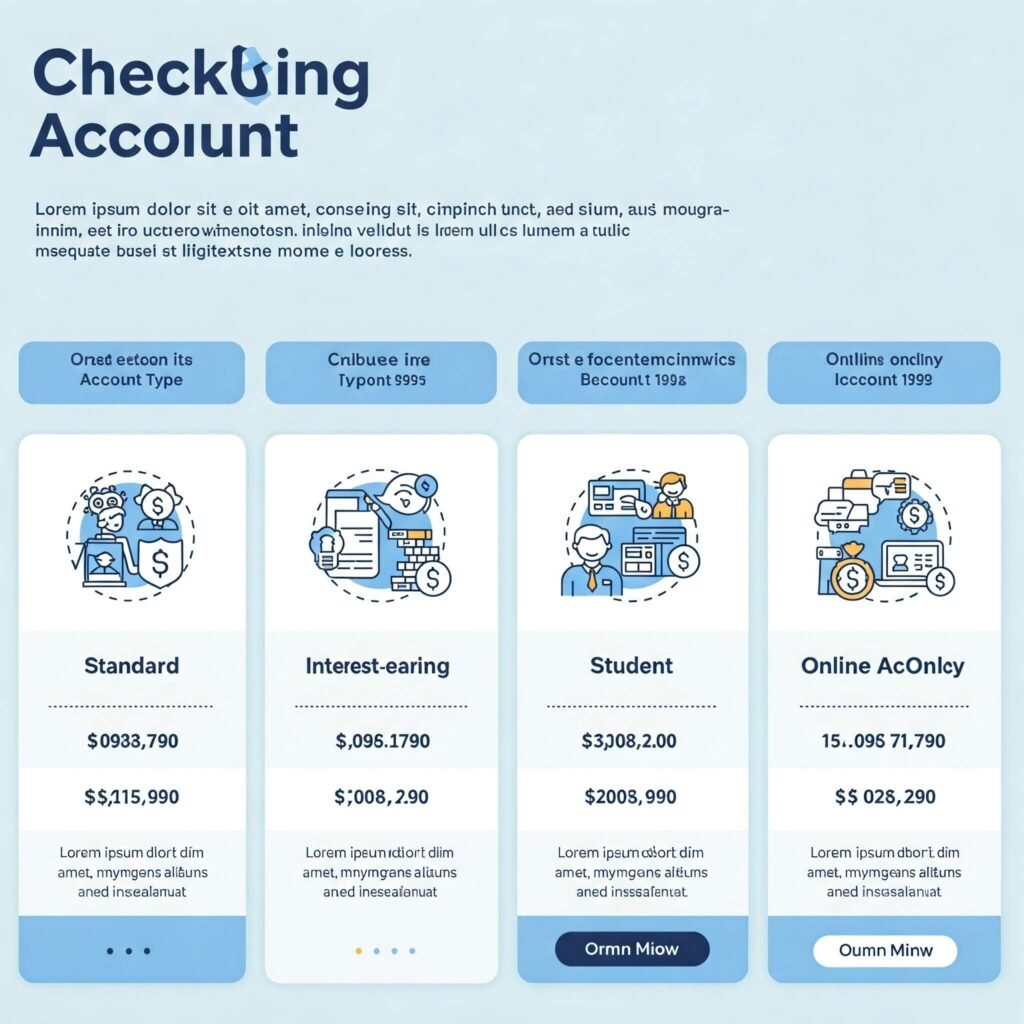

Hunt for No-Fee Checking Accounts

First off, fee-free checking accounts are straight-up clutch—nobody needs $12/month maintenance nonsense. Initially, I stuck with a big bank, got stung with a $50/year fee; consequently, I switched to Varo, zero fees, saved $60 in six months. For example, the pros: your cash stays yours. However, the cons: limited ATMs; I got hit with a $3 out-of-network fee once. Surprisingly, some toss in cashback perks. Check Varo—it saved my broke ass from fee traps.

Chase High-Yield Checking Accounts

Next up, high-yield checking accounts give interest—small, but it stacks. For instance, I found Discover with 0.2% APY; my $800 balance earned $1.60/month, better than zilch. Moreover, the pros: free cash, slick online banking. On the flip side, the cons: balance minimums; I dipped below once, lost interest. Surprisingly, some waive fees for big balances. Scope Discover—forgave my dumb dip mid-rainstorm.

- My Rookie Tip for Choosing a Checking Account: Compare APYs; even 0.1% adds up over time.

- Why It Worked My Mess: Gave my scatterbrain a small W.

Dodge Overdraft Fees for a Smarter Checking Account

Additionally, overdraft protection is a must for a checking account—fees are savage. To illustrate, I got slammed with a $30 fee for a $5 overdraft; switched to a bank with opt-in protection, saved $60 next time. In addition, the pros: no surprise hits. Conversely, the cons: needs a linked savings; I forgot to set one up once, whoops. Surprisingly, some banks forgive one fee a year. Use Bankrate—caught my sloppy math mid-binge.

Go Online-Only for a Flexible Checking Account

Furthermore, online banks like Axos are fire for a checking account—no branches, no fees. Initially, I stuck with a traditional bank, ate a $10/month fee; switched to Axos, free ATMs, saved $45/year. For example, the pros: 24/7 app access. However, the cons: no in-person help; I botched a mobile deposit once. Surprisingly, some toss in signup bonuses. Check Axos—fixed my branch hate.. Cons: no in-person help; I fumbled a deposit once. Surprising: some offer signup bonuses. Check SoFi—fixed my branch hate.

Prioritize Mobile App Features for Your Checking Account

Lastly, a dope app makes a checking account shine—real-time alerts save your bacon. To clarify, Capital One’s app pinged me at $40; stopped a $35 bar overspend. Moreover, the pros: instant tracking. On the other hand, the cons: needs a charged phone; mine died once, total chaos. Surprisingly, some apps auto-budget for you. Scope Capital One—forgave my Wi-Fi crash fumble.

Wrapping My Rant on Choosing a Checking Account: From Fee Hell to Barely Winning

Whew, spilling this while Portland’s rain slaps my window—feels like shaking off a bad bank statement. In conclusion, these checking account hacks didn’t erase my screw-ups (that beer splurge? Still haunts my fridge), but they cut $100 in fees and earned $25 in interest, and I ain’t sweating every swipe anymore. On one hand, I curse bank apps; on the other, I’m hyped for my fee-free vibes—peak Portland hustler, right? Therefore, if you’re in the US grind—fees stacking, balances mocking—snag these checking account tips, shop like I forgot too, and dodge my dumb fees. Got a banking horror? Drop it below, let’s vent over virtual IPAs. (Might’ve flubbed a fee amount, my bad.)

Outbound Link: Choosing the Right Checking Account: High Interest vs. Cash Back at Colorado Credit Union