Scoping out best life insurance policies is overwhelming, yo. I started at my local coffee shop, steam rising from my overpriced latte like my stress levels, Googling away until my phone overheated. Turns out, companies like MassMutual top the lists for overall strength and low complaints. But me? I almost signed up for a sketchy online policy that screamed “scam” after forgetting to check reviews. Embarrassing, but hey, lesson in due diligence.

- Financial strength matters. Look for A++ ratings from AM Best—Northwestern Mutual’s dishing out record dividends in 2025.

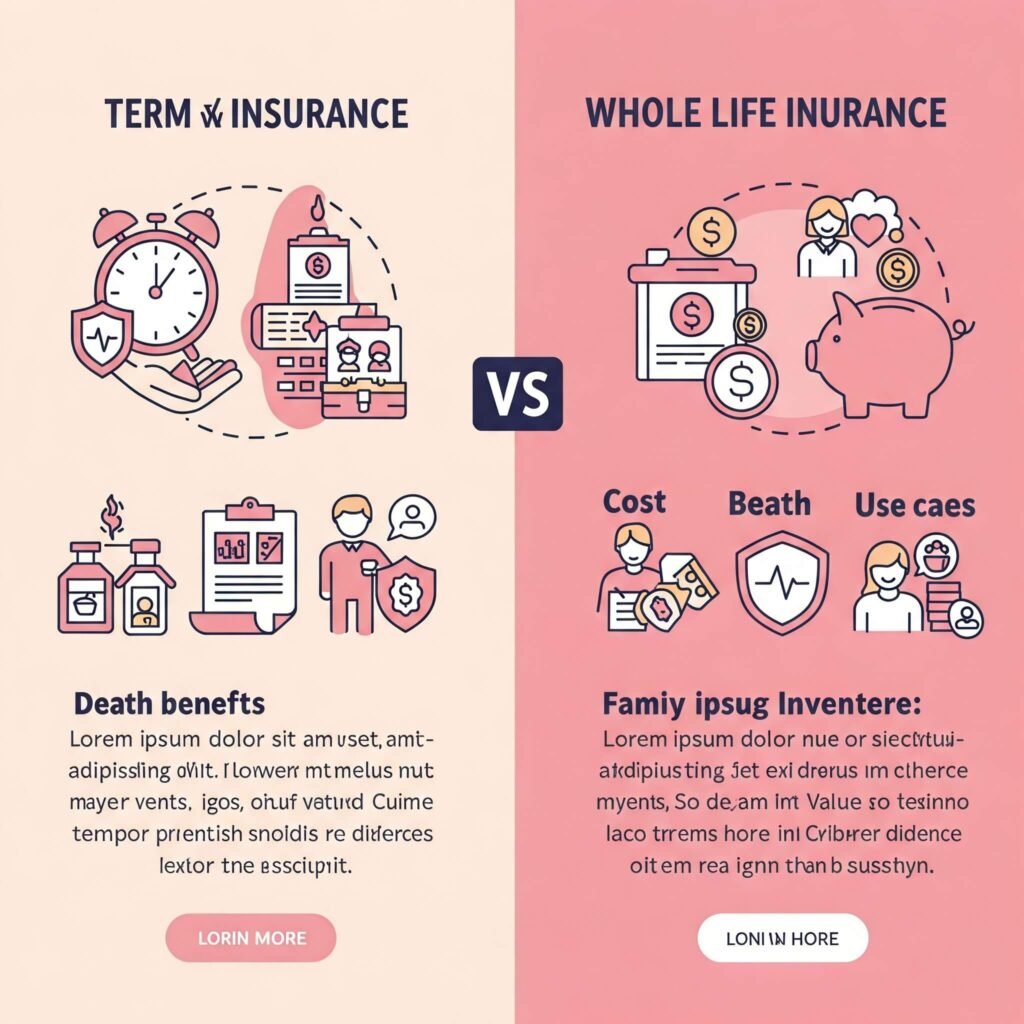

- You’ll overthink it. I did, panicking over term vs. whole like it was the apocalypse.

- Start simple. Term life’s cheap for temp coverage; whole builds cash value but costs more.

Anyway, digress: my garage fridge just hummed louder— like my wallet after bad quotes. Chaos, right?

My Epic Fail in Picking a Policy Type

Term life? Whole? Universal? I mixed ’em up at first, thinking universal was some sci-fi coverage. Protective shines for term with convert options up to age 80. But I nearly bought whole from a pushy agent without reading the fine print—cash value sounds dope until fees eat it. Raw truth: permanent policies like Guardian’s whole life pay dividends yearly since forever, but they’re pricier.

Top Picks for Best Life Insurance Policies in 2025 (My Faves, Flaws Included)

Alright, from my garage deep-dive, here’s the best life insurance policies vibe for 2025. NerdWallet and Forbes rave about MassMutual for diverse options and Guardian for term. Pacific Life and Protective lead term and permanent per Forbes. State Farm wins for customer service, no joke. I like Nationwide for no-exam flexibility.

- MassMutual: Solid all-around, low complaints, term to variable universal.

- Guardian: Killer term and whole, dividends since 1868.

- Northwestern Mutual: Whole life beasts with huge 2025 payouts.

- Protective: Affordable term converts, up to 40 years.

The Time I Almost Botched My Application

Oh god, applying? Nightmare. I filled out an online form for USAA (great for military fams, no-exam whole), but fat-fingered my health history—delayed everything. Surprise: many offer no-exam now, like Nationwide’s four policies. Learned to shop via NerdWallet’s comparator or Forbes Advisor tools.

Tips for Snagging the Best Life Insurance Policies Without Regret

From my flawed grind, here’s advice on best life insurance policies. Automate quotes from multiple spots—LIMRA says premiums hit records in 2025, so shop smart. Add riders like long-term care from Northwestern. But me? I under-covered at first, thinking $250k sufficed—dumb, aim 10-15x income.

- Compare apples to apples. Term for cheap temp (10-30 years), whole for lifetime.

- Check no-exam perks. Symetra and Lincoln tie for best there.

- Review annually. Rates drop with age/health changes? Nah, lock in young.

- Avoid my mistake: Don’t ignore universal’s flexibility—Penn Mutual’s competitive.

Wait, chaos alert: just spilled coffee on my notes—er, term vs. universal? Swapped ’em in my head earlier. Fix: universal adjusts premiums/death benefits.

The Gut-Wrench of Coverage Choices

Picking best life insurance policies? Emotional whiplash. One sec I’m relieved thinking my fam’s set, next I’m contradicting myself—term’s cheap but expires, whole’s forever but bank-breaking. In my garage, surrounded by spiderwebs and doubt, I get it: it’s scary, but skipping it? Worse.

Wrapping My Rant on Best Life Insurance Policies

Whew, that’s my hot take on the best life insurance policies of 2025—garage spills, quote fails, and all. I’m still tweaking mine, probably overpaid a bit, but hey, better than nothing. If I can stumble through, so can you—start with quotes from U.S. News reviews or Bankrate’s awards. What’s your policy horror story? Drop it below, or hit up an agent. Let’s not leave our peeps hanging, yeah?

Outbound Link: 9 types of life insurance policies for seafarers